Before Britain’s new chancellor, Jeremy Hunt, rolled back nearly all of the September mini-budget measures, the first tax cut to be made was Liz Truss’ plan to scrap a corporation tax hike .

The political turmoil caused by the mini-budget has had a negative effect on the public’s perception of this government, and it certainly hasn’t allayed business concerns about the evolution of its fiscal policy. As markets have begun to regain some of the ground lost in recent weeks, the corporate tax reversal appeared to do little to ease market anxiety when announced ahead of the full reversal of the mini-budget on October 17.

For businesses, the problem with corporation tax has been uncertainty and that is what they will want Hunt to address now that he is chancellor.

Many business leaders hailed the September mini-budget, seeing the measures as the country’s best opportunity to grow the economy. The planned abolition of the corporate tax increase to 25% (i.e. keeping the rate at 19% as it has been since 2017) was seen as key in this regard , so the recent trend reversal decision to continue the increase has not been welcomed by enterprises.

Indeed, Confederation of British Industry (CBI) chief executive Tony Danker said after the U-turn that the government should “balance any rise in corporation tax with investment allowances” for ” help achieve both stability and investment”.

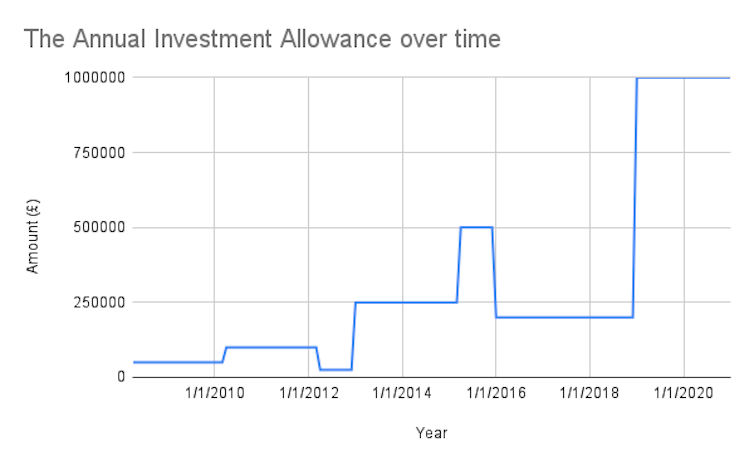

Investment allowances are a form of tax relief that businesses can use to purchase equipment. The UK introduced the Annual Investment Allowance (AIA) in 2008 to boost economic growth by allowing companies to deduct up to £1 million per tax year from chargeable profits for purchases of equipment.

And it’s not just corporate tax rates that have undergone many changes, the AIA claimable amount has been adjusted several times since the AIA was introduced, although the figure of 1 million was one of the few items in the mini-budget not canceled by Chasse on October 17.

But regardless of the rates, thresholds and allowances of any tax, companies need to be able to plan ahead for investments, resource allocation and shareholder compensation. This is not possible when the government keeps changing its tax policies.

Downward trend

The chart below shows the history of the main corporate tax rate since the mid-1970s. It has maintained a generally stable trend, with multiple minor changes, but has gradually fallen to its current level of 19%. By proposing, reversing and then restoring an increase to 25% (which would have been its highest level in ten years), this stability is compromised.

Institute for Tax Studies

Comparison with recent changes to the annual AIA threshold (see table below) reveals further U-turns on the part of the government.

Institute for Tax Studies

It also suggests short-termism and a lack of consistency. This makes it difficult for companies to predict what the AIA threshold might be in the future so that they can plan their spending. The government is keeping the corporation tax rate at 25% and maintaining Kwarteng’s mini-budget policy of keeping the AIA threshold at £1m.

But he also has to decide if anything will be done about the “super-deduction”. This is a temporary special rate of 130% allowances on expenditure, due to expire in March 2023. It allows a company spending, for example, £1m on qualifying investment to deduct £1.3 million in taxable profits and therefore save 19% of that (£247,000) on his corporation tax bill.

The impact on people

It’s not just companies that are currently lacking in confidence. Much interest has focused on the public’s ability to cope with the current cost of living crisis. Rising energy and food prices were the main concern, and a big part of the backlash from September’s mini-budget was that it provided some comfort to low- and middle-income people who would be hit the hardest. by cost increases.

Confidence will now be further shaken by plans by the new chancellor to delay the proposed 1p income tax cut indefinitely, keeping the basic rate at 20%.

But people also affect corporate tax revenue in two ways. First, a reduction in the rate may have led companies to pass on some of the benefits to their customers. The incidence of the tax borne on both the producer and the consumer is a well-established economic concept. This could have stimulated consumer spending and subsequently increased tax revenue.

Nenad Cavoski/Shutterstock

Second, consumer spending declines due to inflation. When combined with rising interest rates that could lead to significantly higher mortgage and rent payments, there is a real danger that a lack of disposable income will continue to hamper growth. This means that revenue from corporation tax will be below government targets.

The next budget plan to be announced on October 31 will include a comprehensive forecast from the Office of Budget Responsibility covering the medium term. To maintain its credibility and offer the public and businesses any assurance of economic stability for the remainder of this period, the government must produce a clear and united budget plan and remain committed to it.

At this time, we don’t know how Truss’ premiership will weather the current political storm, or if his leadership will even survive until the end of October. Two weeks currently seems like an extremely long period in British politics. But to help mitigate economic disruption over the next few years, someone clearly needs to take strong ownership of their fiscal strategy.

With Hunt slashing most of the mini-budget, he clearly hopes to mark the start of a new chapter for the Conservative government. Hopefully this provides the certainty businesses need.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6D3PQFR4HASJYP5NYJXVM66GAM.jpg)