Which type of shareholder owns the most shares of Agrify Corporation (NASDAQ:AGFY)?

If you want to know who actually controls Agrify Corporation (NASDAQ:AGFY), then you’ll need to look at the composition of its stock register. Generally speaking, as a company grows, institutions increase their ownership. Conversely, insiders often decrease their ownership over time. I like to see at least a little insider ownership. As Charlie Munger said “Show me the incentive and I’ll show you the result”.

With a market capitalization of US$105 million, Agrify is a small cap stock, so it may not be well known to many institutional investors. In the chart below, we can see that institutional investors have bought the company. Let’s dig deeper into each owner type to learn more about Agrify.

See our latest analysis for Agrify

What does institutional ownership tell us about Agrify?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

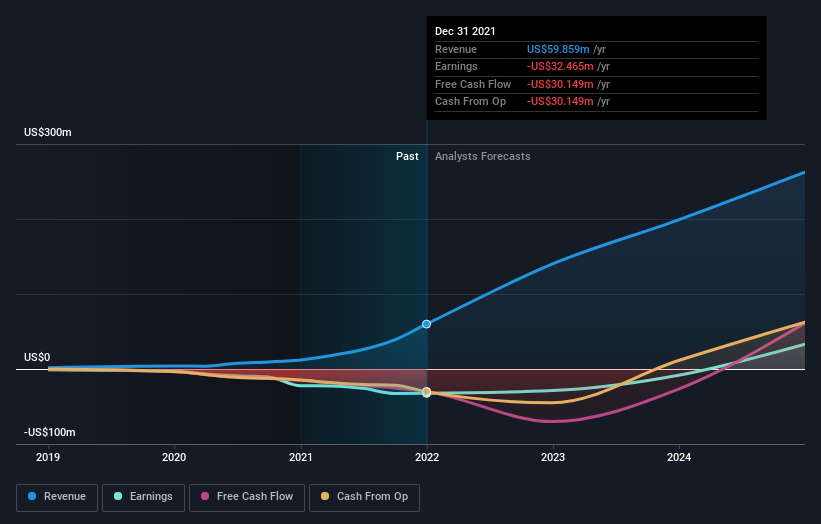

We can see that Agrify has institutional investors; and they own a good part of the shares of the company. This may indicate that the company has some degree of credibility in the investment community. However, it is best to be wary of relying on the so-called validation that accompanies institutional investors. They are also sometimes wrong. If multiple institutions change their minds on a stock at the same time, you could see the stock price drop quickly. So it’s worth checking out Agrify’s revenue history below. Of course, the future is what really matters.

Hedge funds don’t have a lot of shares in Agrify. The company’s largest shareholder is AdvisorShares Investments, LLC, with a 9.1% stake. With respectively 5.7% and 3.3% of the outstanding shares, ETF Managers Group LLC and Dennis Liotta are the second and third shareholders.

A closer look at our ownership data shows that the top 25 shareholders collectively own less than half of the ledger, suggesting a large group of small shareholders where no single shareholder has a majority.

While it makes sense to study data on a company’s institutional ownership, it also makes sense to study analyst sentiment to find out which way the wind is blowing. There are plenty of analysts covering the stock, so it might be interesting to see what they are predicting as well.

Agrify Insider Ownership

The definition of company insiders can be subjective and varies from jurisdiction to jurisdiction. Our data reflects individual insiders, capturing at least board members. Management is ultimately responsible to the board of directors. However, it is not uncommon for managers to be members of the management board, especially if they are founders or CEOs.

I generally consider insider ownership to be a good thing. However, there are times when it is more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own a reasonable proportion of Agrify Corporation. Insiders hold a $13 million stake in this $105 million company. It’s great to see insiders so invested in the company. It might be worth checking to see if these insiders have bought recently.

General public property

The general public – including retail investors – owns 52% of Agrify. With this amount of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to vote on acquisitions or mergers that may not improve profitability.

Private Company Ownership

Our data indicates that private companies hold 3.0% of the company’s shares. Private companies can be related parties. Sometimes insiders have an interest in a public company through a stake in a private company, rather than in their own capacity as individuals. Although it is difficult to draw general conclusions, it should be noted that this is an area for further research.

Next steps:

I find it very interesting to see who exactly owns a company. But to really get insight, we also need to consider other information. Example: we have identified 2 warning signs for Agrify you should be aware.

Ultimately the future is the most important. You can access this free analyst forecast report for the company.

NB: The figures in this article are calculated using trailing twelve month data, which refers to the 12 month period ending on the last day of the month in which the financial statements are dated. This may not be consistent with the annual report figures for the full year.

Feedback on this article? Concerned about content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials. Simply Wall St has no position in the stocks mentioned.