Truss Told Cutting Corporation Tax Won’t Boost UK Investment

Content of the article

(Bloomberg) – Cutting corporate profit levies is no cure for Britain’s poor investment performance, the government of Prime Minister Liz Truss has warned as it prepares to announce tens of billions of dollars. tax gift books.

Content of the article

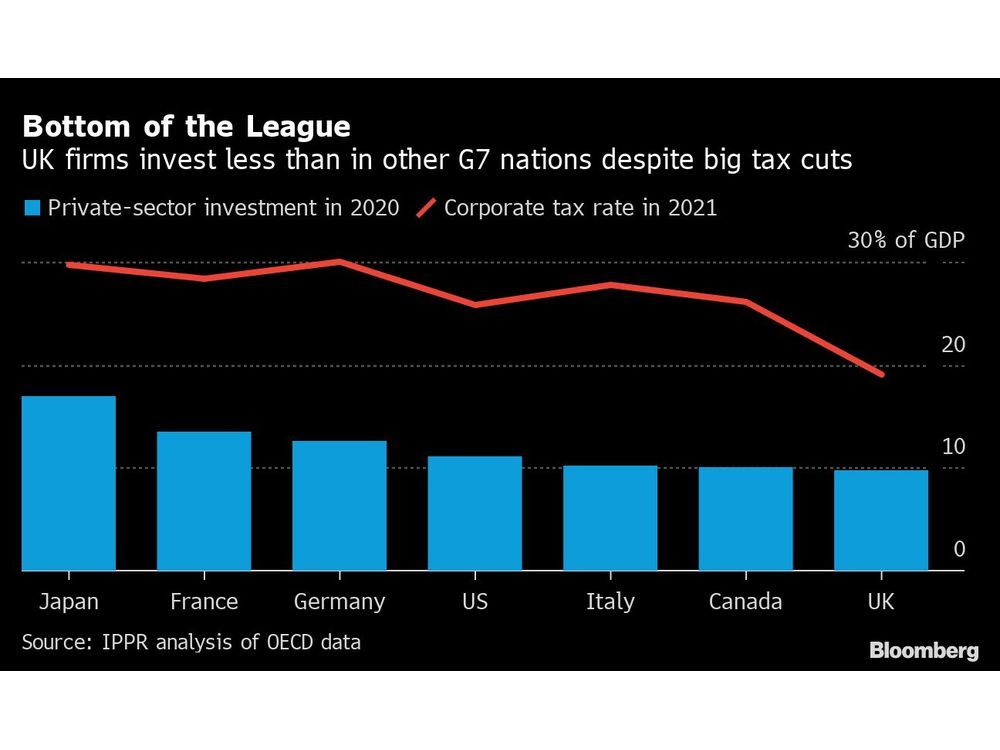

Private sector companies in the UK are investing less than in any other Group of Seven country, despite the sharp decline in corporate tax rates over the past 15 years, the Institute for Public Policy Research has said.

Content of the article

The warning comes days before Chancellor Kwasi Kwarteng is due around £30bn ($34bn) in tax cuts promised by Truss during his campaign to succeed Boris Johnson. They include scrapping a plan to raise the corporate tax rate to 25% from 19% from April. The objective is to stimulate business investment and bring economic growth to around 2.5% per year.

However, the IPPR said there was no evidence that corporate tax cuts of up to 30% in 2007 achieved either goal.

In 2019, the UK fell behind Italy and Canada to have the lowest private sector investment in the G7 as a share of GDP, the IPPR said. The following year, the UK ranked 28th in investment out of 31 countries in the OECD developed country club. Investment has stagnated since the 2016 Brexit referendum and remains below pre-pandemic levels.

Content of the article

“What is clear from this is that the corporate tax cut has failed to increase the disastrous levels of private sector investment in the UK,” wrote George Dibb, director of the Center for Economic Justice at IPPR. “In fact, as we have embarked on the race to the bottom on corporate taxation, our relative performance in business investment has deteriorated.”

The centre-left research group said any tax cuts should be targeted to prevent them being too costly and urged the government to commit to an industrial strategy to boost investment and productivity.

“Such an approach requires sectoral expertise and better overall policy, rather than blanket measures,” Dibb said.

Read more:

- UK plans to halve business energy tariffs as part of bailout

- Sunak warns that additional cost-of-living aid risks fueling UK inflation

- Truss’ plan to ‘turbo-charge’ the UK economy is already alarming the markets

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6D3PQFR4HASJYP5NYJXVM66GAM.jpg)