To print this article, all you need to do is be registered or log in to Mondaq.com.

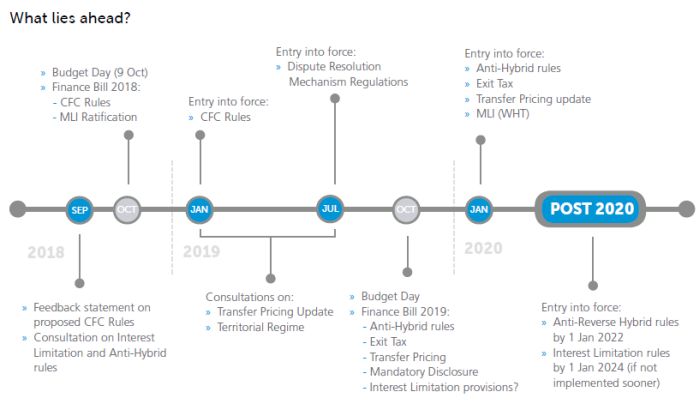

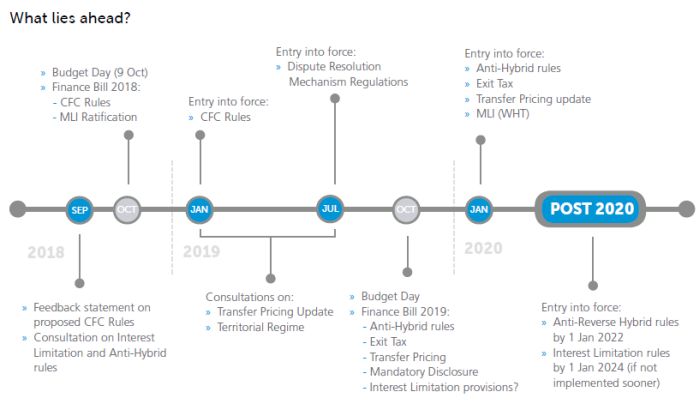

On 5 September 2018, the Minister for Finance and Public Expenditure and Reform published Ireland’s Corporate Tax Roadmap. The roadmap details the corporate tax reform to date and sets out the next steps needed to implement the changes at EU level under the Anti-Tax Avoidance Directives (“ATAD“), the recommendations of the Review of Ireland’s Corporation Tax Code presented by the independent expert Séamus Coffey in June 2017 (the “Coffee review“) and the OECD’s Base Erosion and Profit Shifting project (“BEPSThe roadmap also confirms the timelines for implementing these changes.

Click to view review

The content of this article is intended to provide a general guide on the subject. Specialist advice should be sought regarding your particular situation.

POPULAR ARTICLES ON: Ireland Tax

Ceasing to be a tax resident in the UK – Make no mistake!

Dixcart Group Limited

It’s March 2022 and two people are sitting at the gate at Heathrow waiting for their (inevitably) delayed flight to the Bahamas. They strike up a conversation and explain why they are flying to this Caribbean island.

Tax Considerations – Moving to the UK

Forsters LLP

Individuals and families intending to move to the UK should ensure that they undertake pre-arrival tax planning before a move, so that their affairs are organized as efficiently as possible for UK tax purposes.

The non-dom status of Chancellor Rishi Sunak’s wife

The sovereign group

In the current debate in the UK over the non-domiciled tax status of Chancellor Rishi Sunak’s wife, Akshata Murty, it seems, on the face of it, grossly unfair that the wealthiest overseas residents…

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6D3PQFR4HASJYP5NYJXVM66GAM.jpg)