Another day, another tax title. This week it’s Apple, which faces a €13bn (£11bn) tax bill in Ireland from the EU. Everyone says there has to be a better way to get companies to pay. I also support increasing tax levies, but not by punishing companies. Earlier this year, I argued in The Conversation that it was time for progressives to think the unthinkable and get rid of corporate taxes.

British politicians remain to be convinced, alas. The recent report by the All-Party Parliamentary Group on the Global Tax System stated:

Some experts have argued that we should stop trying to tax global corporate profits. We do not agree. Governments need a range of taxes to fund public services, and corporate profits are part of that range.

They failed to recognize that you could return roughly the same revenue to the state by shifting the burden onto shareholders. How? By fully taxing corporate dividends – and reaping the tax revenue from people selling UK stocks which have risen due to increased corporate profitability after becoming corporation tax free.

But here I want to offer another carrot: charging companies an annual fee to register in the UK.

Corporate tax still falling

Corporation tax brings in around 6% (net of the dividend deduction) of UK tax revenue. Former Chancellor George Osborne intended, following Brexit, to cut UK rates from the current 20% to 15% of pre-tax corporate profits. Philip Hammond, his replacement, has yet to announce a policy but has signaled he could move in the same direction.

Coupled with further erosions of the corporate tax base due to internet commerce and the relocation of intellectual property to more favorable tax regimes, the day is likely soon to come when the UK will struggle to get 4% of its tax revenue from corporation tax. What is it in terms of money? Let’s say £20bn (compared to £30bn, net of tax credits, in 2015-16).

So how much corporation tax would be levied on average on UK corporations each year if tax revenue fell to £20bn? There are 3.5 million limited companies in the UK. But 2 million are inactive, so only 1.5 million are actively traded. This means each business would on average pay just over £13,000 a year to HMRC.

I don’t know the average cost of a business complying with corporation tax each year, but it will be close to £13,000 (much higher for multinationals, much lower for small businesses). And although companies only pay taxes when they make a profit, they have to file tax returns both ways. It should also be remembered that many companies are investigated, appealed and sometimes end up in court, which costs more.

BoBaa22

Plan B

Now suppose we charge an annual fee for the privilege of being a UK company, using a fee scale based on company size. While businesses would now pay to be registered in the UK, most would save more by not having to comply with corporation tax.

You could set the royalty levels to roughly bring back what the government has lost in corporate tax. Plus, the government would still have the higher dividend and capital gains income I talked about earlier. In total, state revenues would have increased substantially.

Collecting these fees would be simple. Companies would pay this when they submit their confirmation statement (the replacement for the annual report). Penalties and interest would apply if payments were late – another source of funding for the government.

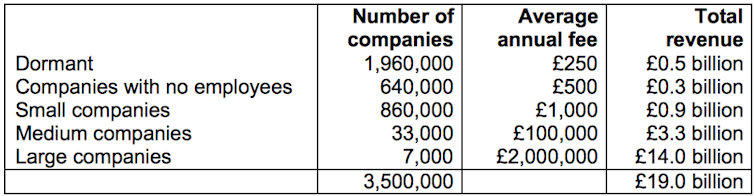

More information would be needed to determine the number of fee bands and fees per band for these new business fees, but below is a possible structure. Although the rates are of course much higher for large corporations, they are probably still comparable to what they spend to manage their tax affairs.

I’ve spoken to a few people who run or are involved in businesses about how they would react to a system like this. What was their reaction? They would bite your hand to sign up, basically.

And a final thought. If the UK abolished corporation tax, where do you think Apple, Google and others would consider moving given the problems the EU has created for Ireland?

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6D3PQFR4HASJYP5NYJXVM66GAM.jpg)