Global corporate tax will bring down Big Tech by 2023

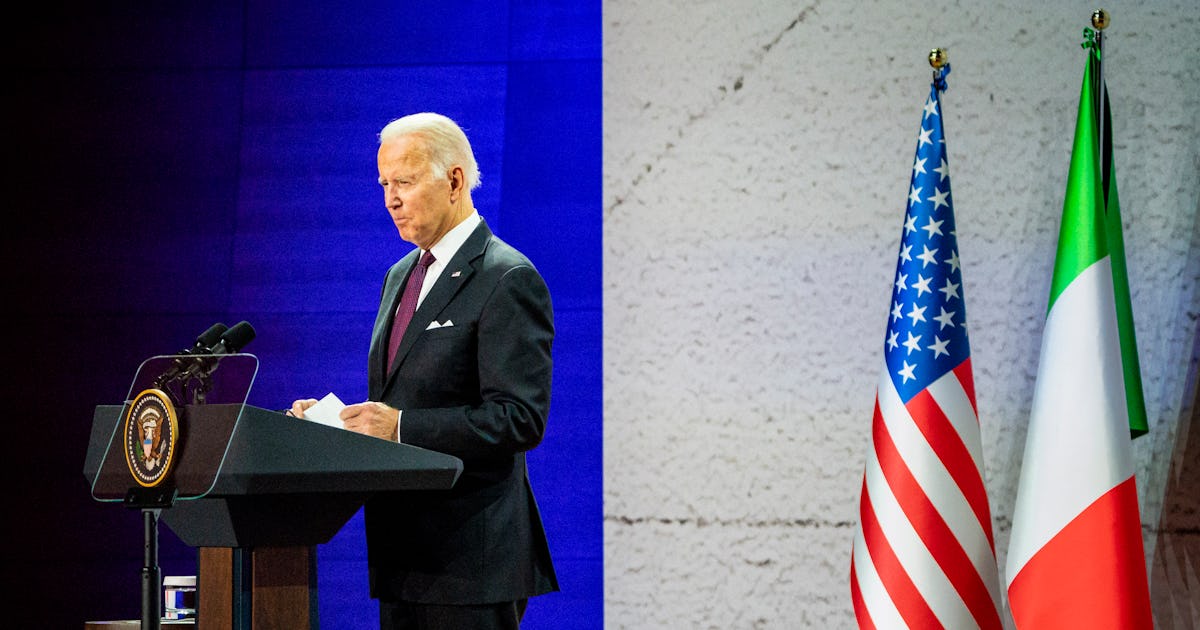

President Biden made an intriguing and long-standing argument at this year’s G20 summit: a minimum tax for the world’s largest corporations, mandated and enforced around the world. All of the world leaders present agreed, and so a global corporate tax was born. The tax agreement, which will be applied by 2023, sets a minimum tax rate of 15% for companies with turnover above 750 million euros, or about 867 million dollars. The global reach of the deal is expected to make it much more difficult for companies to flee the country in search of more lenient tax laws.

“This reform will make our international tax system fairer and function better in a digitized and globalized world economy,” said Mathis Cormann, Secretary General of the Organization for Economic Co-operation and Development (OECD) in welcoming this year’s G20. Declaration of the leaders.

The 15 percent minimum has in fact been accepted by many more governments than those at the top; a total of 136 countries and jurisdictions will apply the law. These territories represent 94% of world GDP.

It’s time – The minimum corporate tax will generate around $ 150 billion in new revenue around the world, once it is operational. This additional money is obviously a great motivation for the countries involved in the agreement. Who would say no to a few more billions in the budget?

For the public, however, there is another huge incentive here: fairness. The world’s biggest companies use tax loopholes year after year, while the rest of us have some of the money taken from every paycheck.

The ongoing pandemic has made this imbalance even more apparent. Zoom, which generated more than $ 660 million in profits last year, paid exactly zero dollars in taxes.

Better luck abroad than at home – The OECD’s crushing deal on this corporate tax minimum sends a strong message to the world’s biggest companies: stop running away. It is directly aimed at this sole objective.

The deal won’t change much for US-based companies, given that the federal corporate tax rate is already 21%. One of Biden’s campaign promises was to restore that rate to 35% before Trump. Today, the president failed to convince lawmakers that even a 28% increase would be worth the business blow.

Notably, the global minimum tax rate will not increase tax rates for the world’s richest people, only their businesses. Crossing this bridge is a whole other problem.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/6D3PQFR4HASJYP5NYJXVM66GAM.jpg)