Boxlight Corporation – Company Pulls All Cylinders – Buy (NASDAQ: BOXL)

To note:

I have covered Boxlight Corporation (NASDAQ: BOXL) before, so investors should consider this an update to my previous articles about the company.

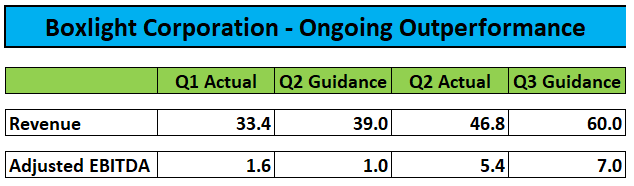

Last week, Boxlight Corporation or “Boxlight” reported better than expected second quarter results and provided a truly stellar outlook for the third quarter.

Revenue of $ 46.8 million and Adjusted EBITDA of $ 5.4 million were well above management’s projections of $ 39 million and $ 1 million respectively. Boxlight’s orders-to-bill ratio for the quarter hit a record 1.62, with the vast majority of the company’s $ 48 million backlog due in the third quarter.

Source: Company press releases

The revenue forecast of $ 60 million in the third quarter was significantly higher than analysts’ expectations and the Adjusted EBITDA margin is expected to improve slightly from the 11.5% recorded in the second quarter.

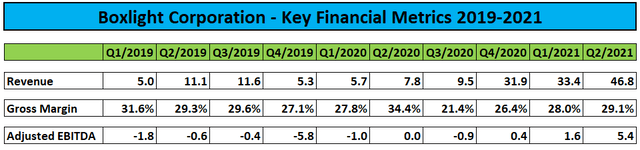

While last year’s acquisition of UK-based Sahara Presentation Systems (“Sahara”) was certainly a game-changer for Boxlight, the company’s core US business is also gaining ground, as This is evidenced by the 184% organic growth in orders recorded. for Q2.

Gross margins have been affected by up to 400 basis points due to increased freight and customs costs caused by supply chain challenges associated with the effects of COVID-19 which are likely to persist in a foreseeable future.

Source: Company press releases

Following the publication of the results, management held an almost flawless conference call highlighting widespread demand across all regions and product lines.

In addition, the company’s strategic partnership with Samsung appears to be gaining momentum, with the number of bundled MimioConnect software licenses expected to nearly double this quarter.

That said, rapid growth coupled with long lead times for some hardware solutions has resulted in increased working capital requirements and associated pressure on cash flow.

The company alleviated the problem by further increasing its accounts receivable funding agreement with Sallyport Commercial Finance LLC, but nonetheless, cash and cash equivalents declined by about $ 6 million to $ 7.4 million in the year. first semester.

In addition, the company extended the date of completion of the buyback and conversion agreement with the former owners of Sahara until the end of the year, thus providing additional time to meet the requirement of buy back its Series B preferred shares for a cash payment of £ 11.5million. Success would automatically trigger the conversion of the company’s Series C preferred shares into approximately 7.6 million common shares.

In addition, Boxlight continues to manage the $ 22 million toxic convertible notes issued to Lind Global Asset Management LLC (“Lind Global”) last year to partially fund the Sahara acquisition.

With redemptions made in common stock valued at a 10% discount to the average of the five lowest daily VWAPs in the 20 trading days prior to issuance, Lind Global has a strong incentive to short-sell the shares of the company before the monthly payments.

During the first half of the year, the company repaid combined principal of $ 6.8 million and interest of $ 0.4 million by issuing a total of 3.9 million common shares to Lind Global with 14.3 millions of dollars still outstanding under the Notes.

Assuming a stable share price, Boxlight would need to issue an additional 7.8 million shares to process the remainder of the convertible notes.

In addition, the company will need to provide approximately $ 16 million in cash at current exchange rates to redeem the Series B preferred shares until the end of the year.

Even assuming Boxlight manages to raise non-dilutive capital to repay the former owners of Sahara, the above-mentioned automatic conversion of the company’s Series C preferred shares will likely result in approximately 75 million shares outstanding in twelve months. , up from around 60 million last week.

That number could easily exceed 80 million if the company were to raise additional capital to repay the Series B preferred shares.

Conclusion:

Boxlight’s business is apparently in full swing, as evidenced by another solid quarterly report and stellar forecast for the third quarter.

On the flip side, the company continues to face headwinds related to high transportation costs, increased working capital requirements and the continued dilution of funding for toxic convertible notes from last year, as well as the need to redeem its Series B preferred shares for approximately $ 16 million in cash. until the end of this year.

Given the strong business outlook, Boxlight should be able to secure non-dilutive funding to process the Series B preferred shares later this year and maybe even be successful in establishing a revolving credit facility at some point, but this will not prevent further dilution of last year’s convertible notes and the upcoming redemption of Series C preferred shares.

But even if the company decides to raise additional capital to cope with the Series B preferred share buyback and high working capital requirement, I would happily use a potential follow-up offer to buy back the shares of the company or add to an existing position at that time.

I’m increasing my short-term price target to $ 5 based on 1.5x my estimated revenue for fiscal year 2022 of $ 250 million.

Buy with both hands for over 100% short term bullish and feel free to add weakness.