Bank of America Corporation (NYSE:BAC) is favored by institutional owners who own 58% of the company

If you want to know who actually controls Bank of America Corporation (NYSE: BAC), you’ll need to look at the composition of its stock register. We can see that institutions hold the lion’s share of the business with 58% ownership. In other words, the group is likely to gain the most (or lose the most) from its investment in the business.

Given the huge amount of money and research capabilities at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. Therefore, having a considerable amount of institutional money invested in a business is often considered a desirable trait.

Let’s dive deeper into each type of Bank of America owner, starting with the table below.

However, if you prefer to see where opportunities and risks are within BAC’s industryyou can consult our analysis on the US banking sector.

What does institutional ownership tell us about Bank of America?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

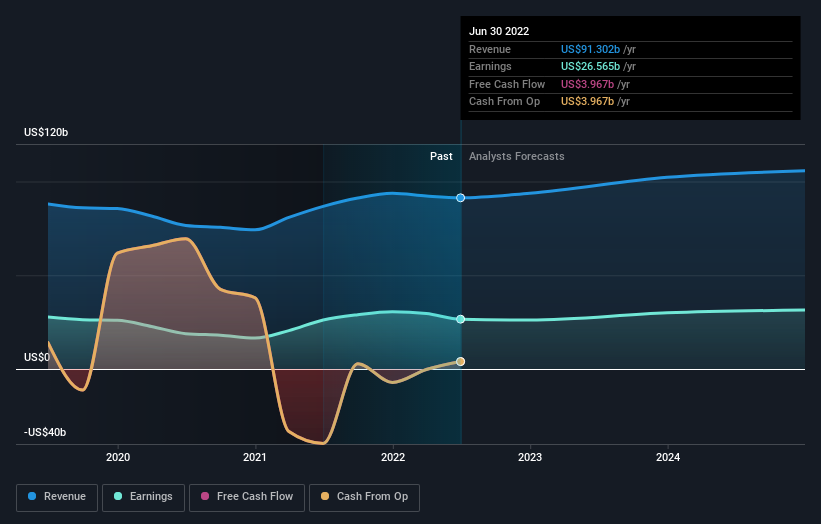

As you can see, institutional investors own a sizeable portion of Bank of America. This suggests some credibility with professional investors. But we cannot rely solely on this fact since institutions sometimes make bad investments, like everyone else. It is not uncommon to see a sharp decline in the stock price if two large institutional investors attempt to sell a stock at the same time. So it’s worth checking out Bank of America’s past earnings trajectory (below). Of course, keep in mind that there are other factors to consider as well.

Institutional investors own more than 50% of the company, so together they can probably heavily influence board decisions. We note that hedge funds have no significant investment in Bank of America. Looking at our data, we can see that the largest shareholder is Berkshire Hathaway Inc. with 13% of the shares outstanding. With 7.5% and 6.1% of the shares outstanding, respectively, The Vanguard Group, Inc. and BlackRock, Inc. are the second and third largest shareholders.

Our studies suggest that the top 25 shareholders collectively control less than half of the company’s shares, which means that the company’s shares are widely distributed and there is no dominant shareholder.

While it makes sense to study data on a company’s institutional ownership, it also makes sense to study analyst sentiment to find out which way the wind is blowing. A number of analysts cover the stock, so you can look at growth forecasts quite easily.

Bank of America Insider Ownership

The definition of company insiders can be subjective and varies from jurisdiction to jurisdiction. Our data reflects individual insiders, capturing at least board members. Management is ultimately responsible to the board of directors. However, it is not uncommon for managers to be members of the management board, especially if they are founders or CEOs.

Most view insider ownership as a positive because it can indicate that the board is well aligned with other shareholders. However, there are times when too much power is concentrated within this group.

Our information suggests that Bank of America Corporation insiders own less than 1% of the company. It’s a very big company, so it would be surprising to see insiders owning much of the company. Although their stake is less than 1%, we can see that the board members collectively own $443 million worth of shares (at current prices). In this kind of situation, it may be more interesting to see whether these insiders have been buying or selling.

General public property

The general public, who are usually individual investors, own a 30% stake in Bank of America. This size of ownership, although considerable, may not be sufficient to change company policy if the decision is not in line with other major shareholders.

Ownership of a public company

Public companies currently own 13% of Bank of America shares. It may be a strategic interest and both companies may have related business interests. They may have separated. This exploitation probably deserves further investigation.

Next steps:

It is always useful to think about the different groups that own shares in a company. But to better understand Bank of America, we need to consider many other factors. Be aware that Bank of America shows 1 warning sign in our investment analysis you should know…

But finally it’s the future, not the past, which will determine the performance of the owners of this company. Therefore, we think it’s advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: The figures in this article are calculated using trailing twelve month data, which refers to the 12 month period ending on the last day of the month the financial statements are dated. This may not be consistent with the annual report figures for the full year.

Feedback on this article? Concerned about content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials. Simply Wall St has no position in the stocks mentioned.

Valuation is complex, but we help make it simple.

Find out if Bank of America is potentially overvalued or undervalued by viewing our full analysis, which includes fair value estimates, risks and warnings, dividends, insider trading and financial health.

See the free analysis