Air Lease Corporation: The $800 Million Mistake in Russia (NYSE:AL)

Alexey Kartsev/iStock Editorial via Getty Images

In recent reports, I analyzed the presence of leased aircraft in Russia. What we found was that Russian airlines were more dependent on aircraft leasing than the rest of the world. A die This is because Russia was hit with sanctions when it annexed Crimea years ago, making it harder for Russian airlines to finance planes. Leasing has become a good alternative, but now leaves lessors vulnerable in Russia, with sanctions particularly targeting aerospace products and services.

In this report, I will provide an update on the matter for Air Lease Corporation (NYSE:AL) because things have changed significantly for the lessor compared to what he previously communicated.

A fake shield

Aircraft Air Lease Corporation (Air Lease Corporation)

A few days after the invasion of Ukraine, I provided a report in which I explained that the invasion could trigger radiation. This article focused primarily on the significant price declines we’ve seen in AerCap stock prices, but the note on potential write-offs was certainly something that applied to all Russia-exposed backers.

One thing we saw repeatedly mentioned by investors and readers who were critical of AerCap was that they had significantly higher exposure to Russia. However, in the days following the invasion, we developed the TAF Airline Fleet Monitor Russia, which tracks aircraft in Russia by lessor and airlines, and what we found was that between AerCap and Air Lease Corporation there was no huge difference in measured exposure relative to the value of their flight equipment. So while the impression was that Air Lease Corporation had better risk management, this could not be confirmed by the numbers at all. It should be noted that browsing more than 900 aircraft is tedious work, and obtaining fully accurate information is quite difficult. We found that there were 31 Air Lease Corporation planes leased to Russian airlines worth approximately $1.1 billion, which is more or less less in line with the 29 planes of a worth $1 billion than the lessor communicated. In fact, we found two planes that we had previously assigned to Air Lease Corporation but which actually belonged to other lessors. This gave us 29 aircraft worth $1 billion, as communicated.

What’s interesting is that at the beginning of March, I pointed out that the risks of impairment had increased, but on March 16, Air Lease Corporation mentioned that she saw no reason to damage her assets. The fact that Air Lease Corporation had no aircraft on lease with common carriers was apparently cited as a reason to support the assumption that the write-downs were unnecessary. However, President Putin’s law that would allow airlines to take control of leased assets was not just limited to public entities, and the assumption that private airlines would not engage in aircraft re-registration without authorization was found to be invalid at midday. -March 17% of Air Lease aircraft active in Russia had been re-registered. Air Lease Corporation’s key assumption that supported no impairment charges and subsequently kept the stock price afloat was found to be false using data obtained from our monitors.

So in my opinion a risk of depreciation was never out of the question and we were shown April 22 as Air Lease Corporation disclosed an impairment of $802.4 million on its frozen assets in Russia:

In response to the sanctions, the Company terminated the lease of all aircraft leased to Russian airlines. The Company has determined that the Company is unlikely to repossess the aircraft that have not been returned and remain in Russia, representing 21 aircraft in the Company-owned fleet and six aircraft in the company-managed fleet. the society. On April 19, 2022, in connection with the preparation and review of the Company’s quarterly financial statements for the quarter ended March 31, 2022, the Company determined that it planned to record a write-off of its interests in its owned and managed fleet that remain in Russia, totaling approximately $802.4 million. The Company does not expect that the write-off of these assets will result in material future cash outlays for the Company. The Company is vigorously pursuing insurance claims to recover losses related to these aircraft. The Company’s financial information provided in this report is an estimate and subject to change. The Company’s financial closing procedures for the quarter ended March 31, 2022 have not yet been completed and there can be no assurance that the Company’s final results for such period will not differ from these estimates.

This is a good time to realize that not everything a company claims is true or continues to be valid over a longer period of time. Investors who followed my analysis would probably have seen that the risk of depreciation weighed heavily even for Air Lease Corporation. The company announced an impairment on 27 jets that had not been returned. Our monitor showed 26 unreturned jets worth $926 million. So there is some difference in the numbers, but the differences are not huge.

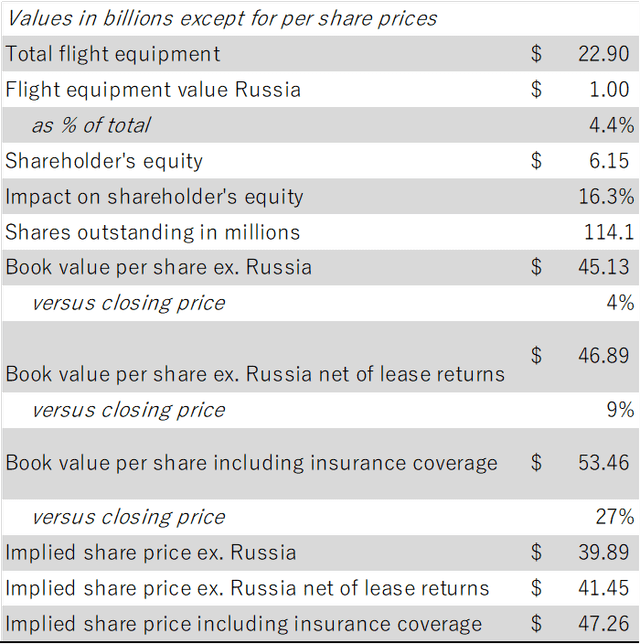

Using the information we currently have, we modeled the following:

Air Lease Corporation Assessment (The Aerospace Forum)

Where previously we were seeing implied stock prices of $40.50 net of rental returns, now we see stock prices of $41.45. As you can see, as Air Lease Corporation announced an impairment charge, our modeled share price rose. This is because our modeling was not based on Air Lease’s dubious assumption that an impairment would not be necessary. Additionally, the value of flight equipment in Russia before the invasion is slightly lower than we originally modeled, providing an increase of $0.46 per share, while the value of returned assets appears to be higher. than originally planned, offering an increase of $0.50. I think overall it was good not to let our stock price modeling rest on Air Lease Corporation’s assumption that it could return a significant number of aircraft placed with Russian airlines and that impairment charges were not necessary. Shares of Air Lease Corporation were down 5% in post-market action on Friday and are trading at $42.10. Based on the implied share price excluding Russian leases net of lease yields, there appears to be around 1.5% further downside, but if we model the insurance coverage which at this point is a big unknown, there would be about a 12% increase.

Conclusion

While Air Lease Corporation claimed in mid-March that there was no risk of impairment at the time, the lessor had to backtrack on that statement just over a month later by announcing a charge of $802.4 million writing off about 80% of the value of the aircraft he had placed with Russian operators before the invasion. In my opinion, over the past few weeks, there have not been any major changes that have made the situation materially different for Air Lease Corporation. It’s just that their mid-March working hypothesis was flawed and unrealistic.

Simultaneously, based on the lower value of flight equipment and higher value of returned assets, our price target for Air Lease Corporation has increased as our valuation was not based on questionable assumptions made by Air Lease. However, it should be noted that this benefit only exists on the condition that insurance companies pay and at this time we do not know to what extent Air Lease Corporation has enforceable insurance policies in place and this will likely become a legal battle with insurers. to get the money.

Overall, as the impairment charge reduces risk and aligns Air Lease Corporation with bitter reality and our implied stock price estimate has risen instead of fallen, I feel more comfortable with my investment in AerCap (AER) than I would with an investment in Air Lease Corporation. The main reason for this is that AerCap’s assumption of the impairment charge risk has been more realistic than that of Air Lease. This is not to say that Air Lease Corporation is any less attractive now in the longer term, as it is actually aligned with reality after the burden and risk has been mitigated or better said recognized and absorbed.